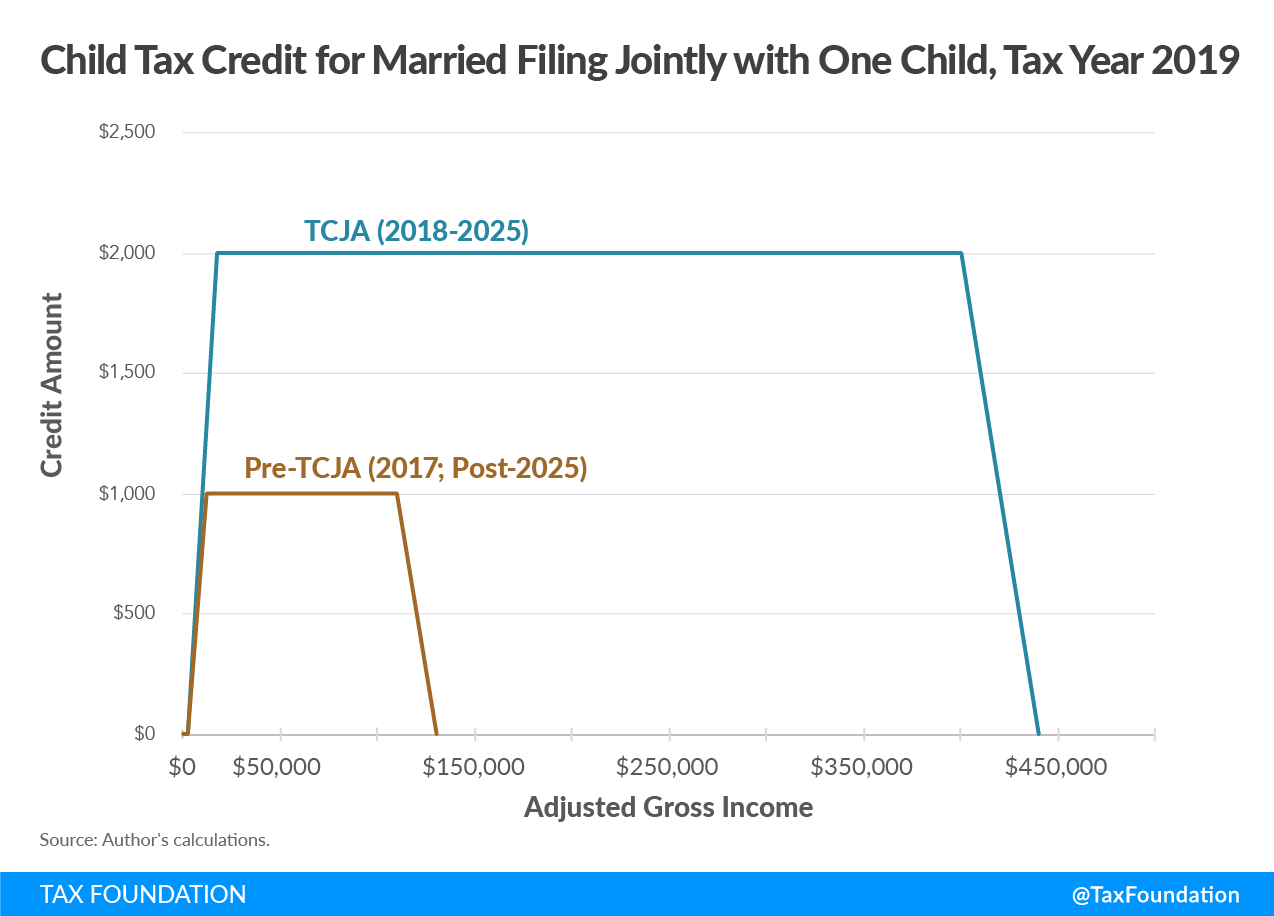

Child Tax Credit 2024 Phase Out Limits – Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . However, exceeding the specified income limits will result in a reduction of the credit amount. Taxpayers can claim the child tax credit when filing their tax returns in 2024, emphasizing the .

Child Tax Credit 2024 Phase Out Limits

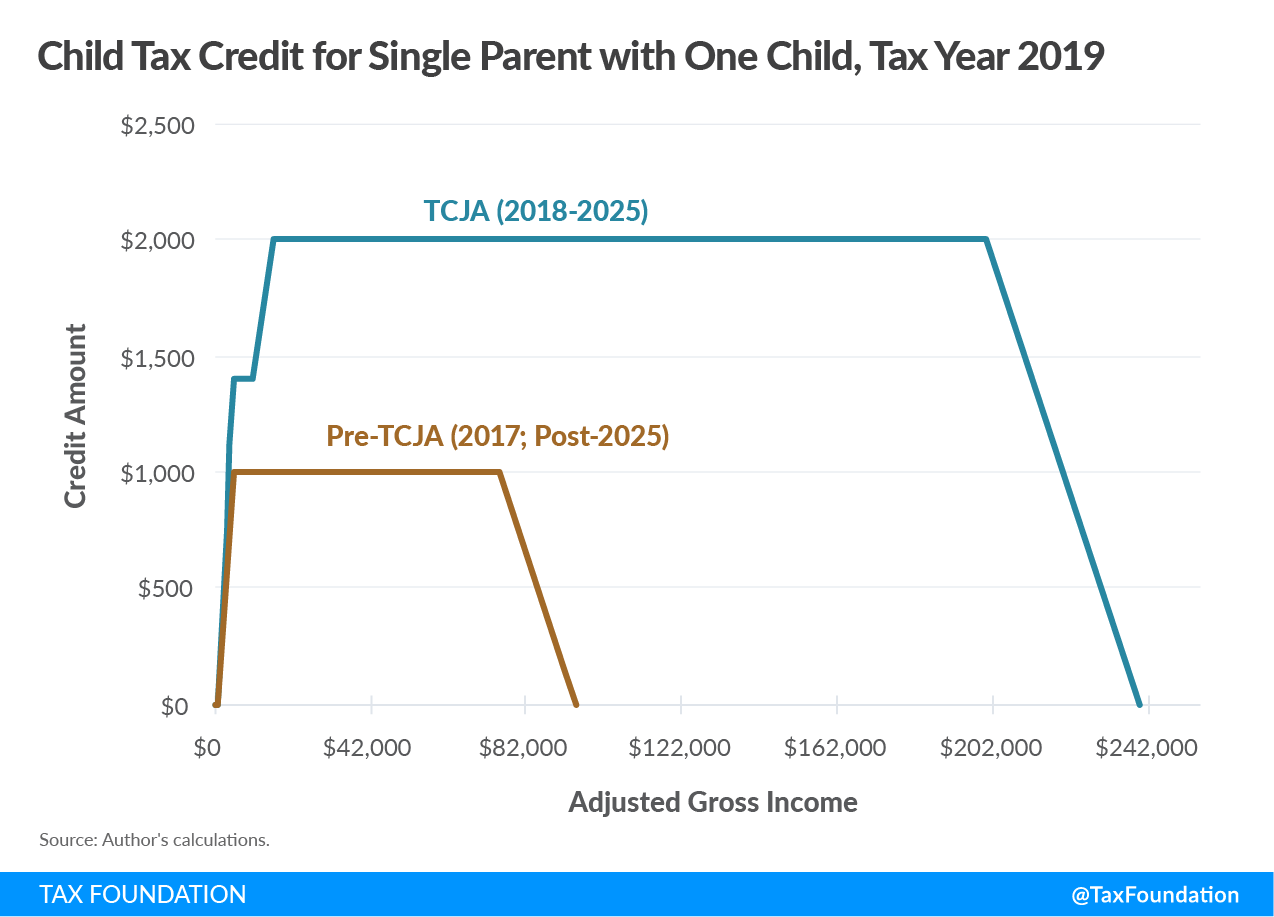

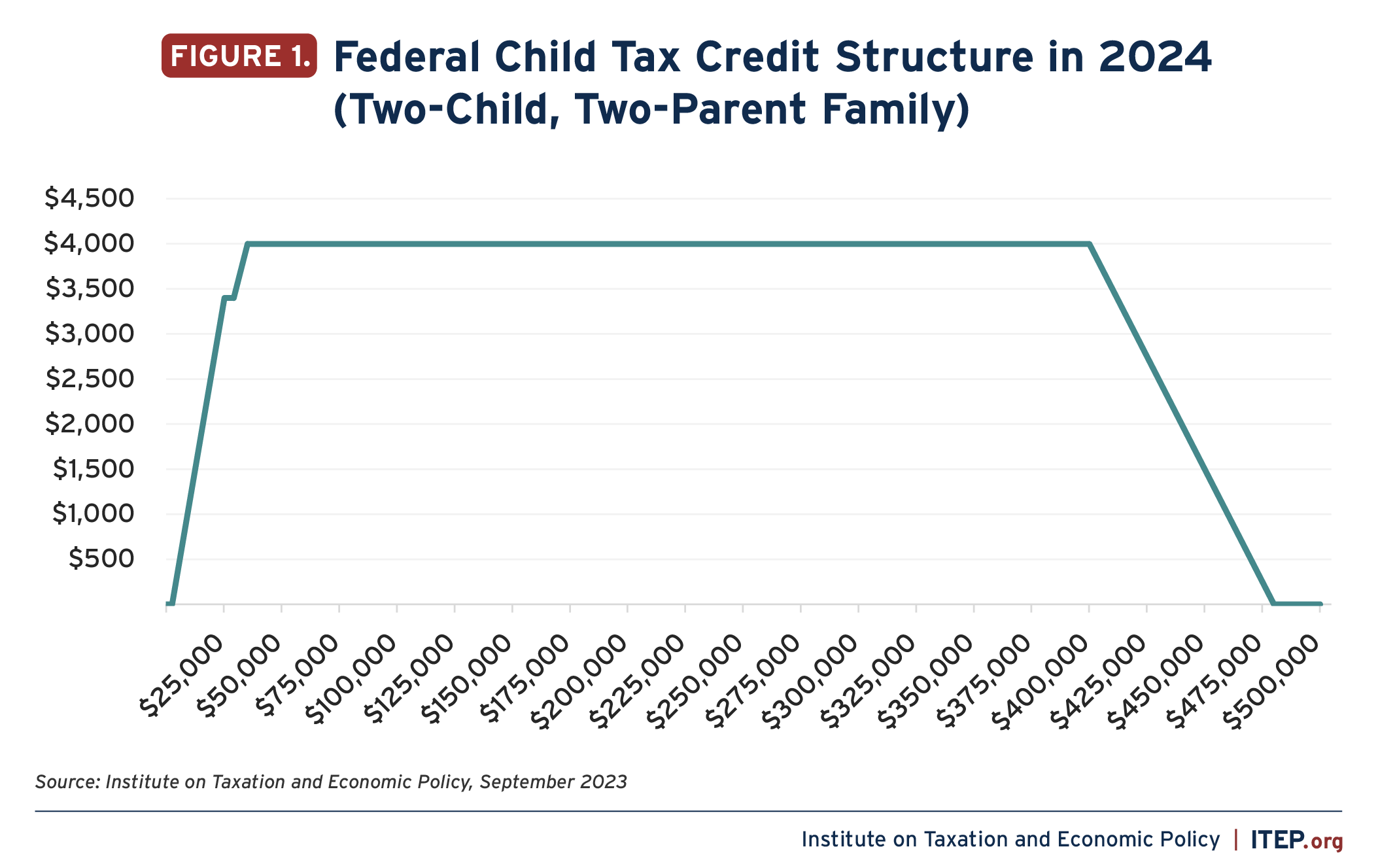

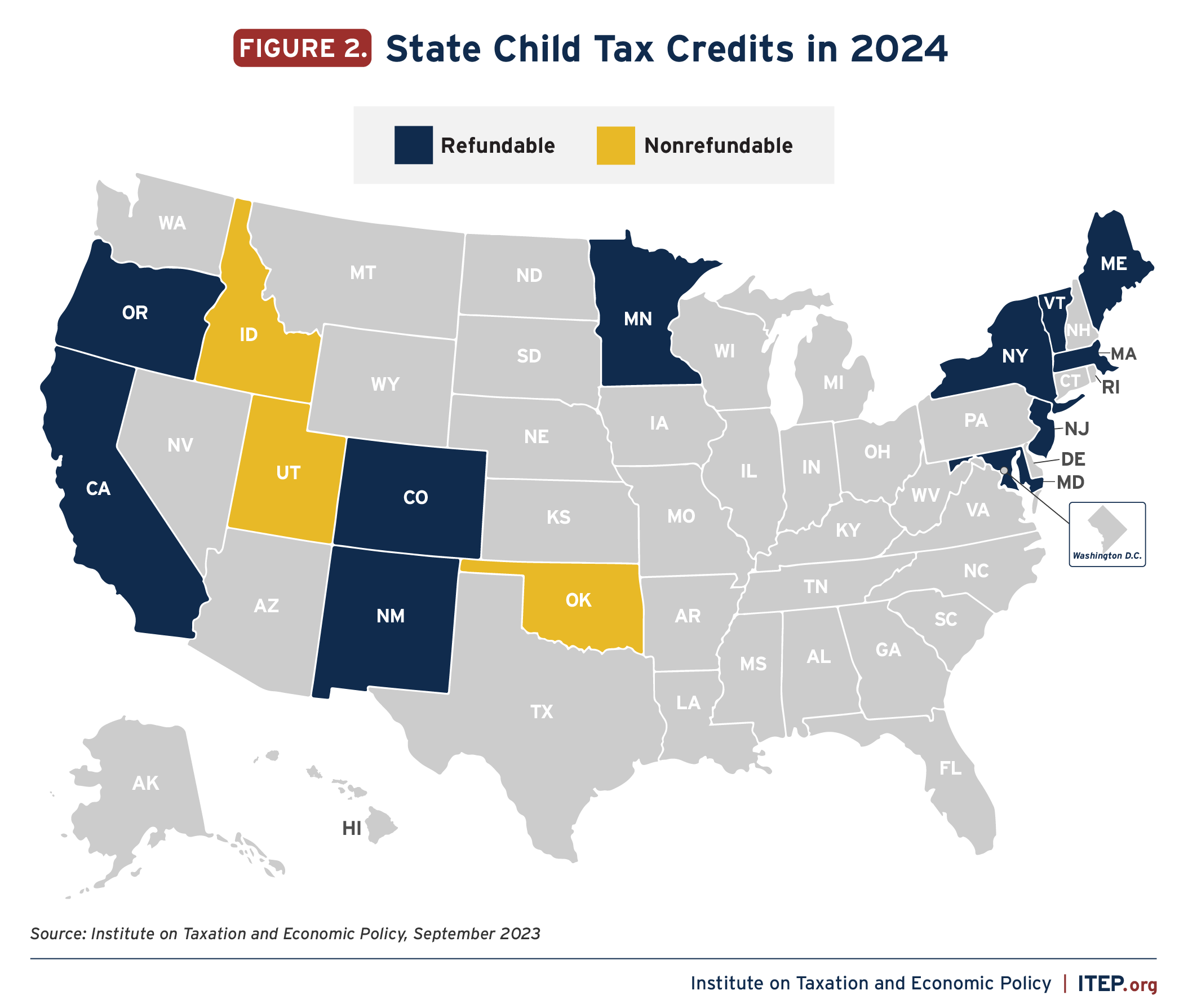

Source : itep.orgThe American Families Plan: Too many tax credits for children

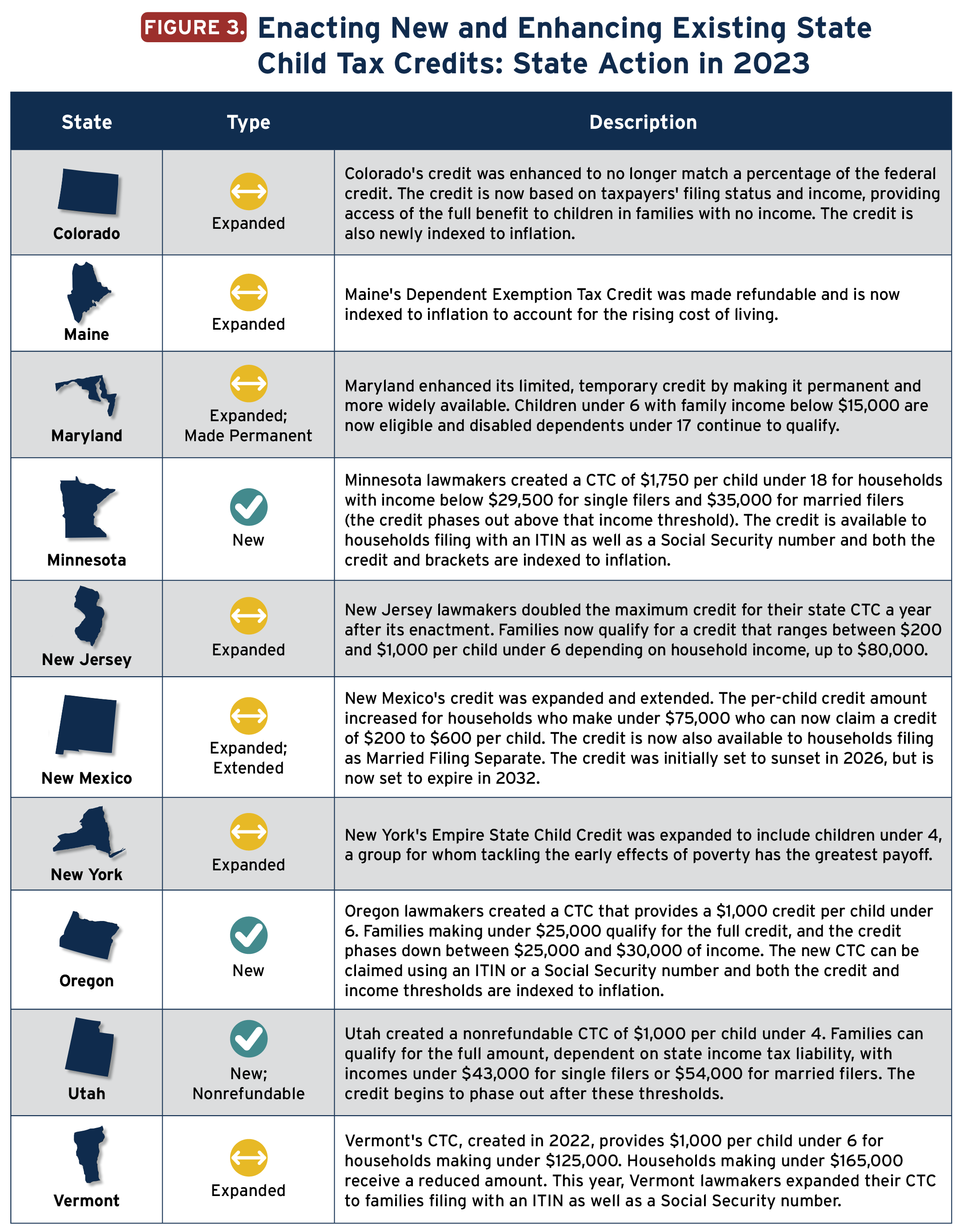

Source : www.brookings.eduStates are Boosting Economic Security with Child Tax Credits in

Source : itep.orgChild Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.orgStates are Boosting Economic Security with Child Tax Credits in

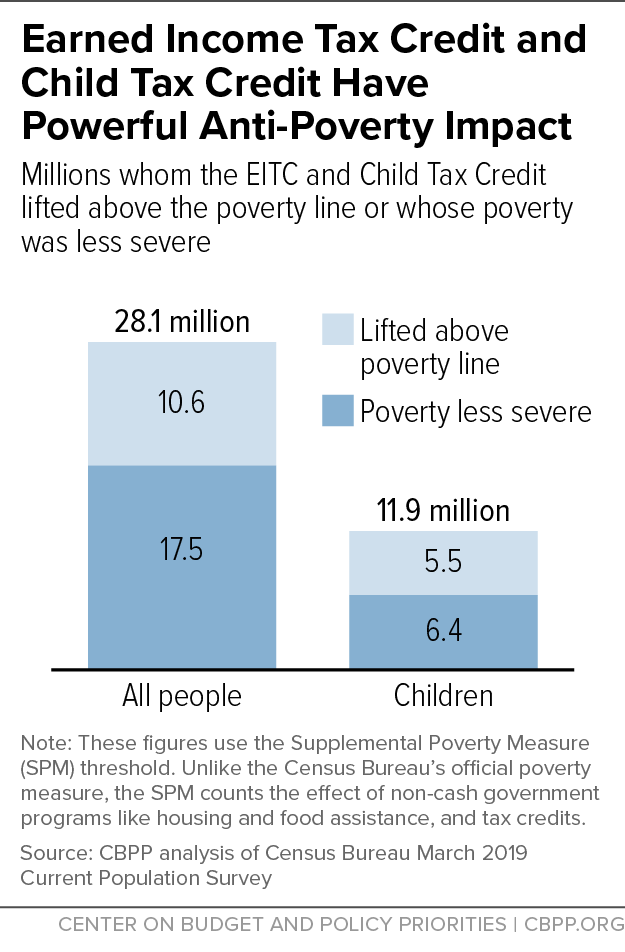

Source : itep.orgPolicy Basics: The Earned Income Tax Credit | Center on Budget and

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.comChild Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.comChild Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.orgChild Tax Credit 2024: Should You Hold Off on Filing Your Taxes

Source : www.cnet.comChild Tax Credit 2024 Phase Out Limits States are Boosting Economic Security with Child Tax Credits in : 2024, and 2025. Penalties removed for larger families: to ensure equitable application of the child tax credit phase-in to households with multiple children. A one-year income lookback . While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. .

]]>

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)