Child Tax Credit 2024 Congress Update – Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . The bill would incrementally raise the amount of the credit available as a refund, increasing it to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax returns. The .

Child Tax Credit 2024 Congress Update

Source : itep.orgAlec Stapp on X: “Positive update from DC: Looks like negotiators

Source : twitter.comChild tax credit could change — but don’t wait to file taxes, IRS says

Source : www.cnbc.comSenator Andrew Gounardes on X: “This is great news, but we can’t

Source : twitter.comBipartisan deal to expand child tax credit, revive business tax

Source : nebraskaexaminer.comExpanding the Child Tax Credit Would Advance Racial Equity in the

Child tax credit expansion, business incentives combined in new

Source : kansasreflector.comChild Tax Credit Changes | What Families Need to Know | Money

Source : www.youtube.comChild tax credit expansion, business incentives combined in new

Source : coloradonewsline.comVideo New proposal could expand child tax credit ABC News

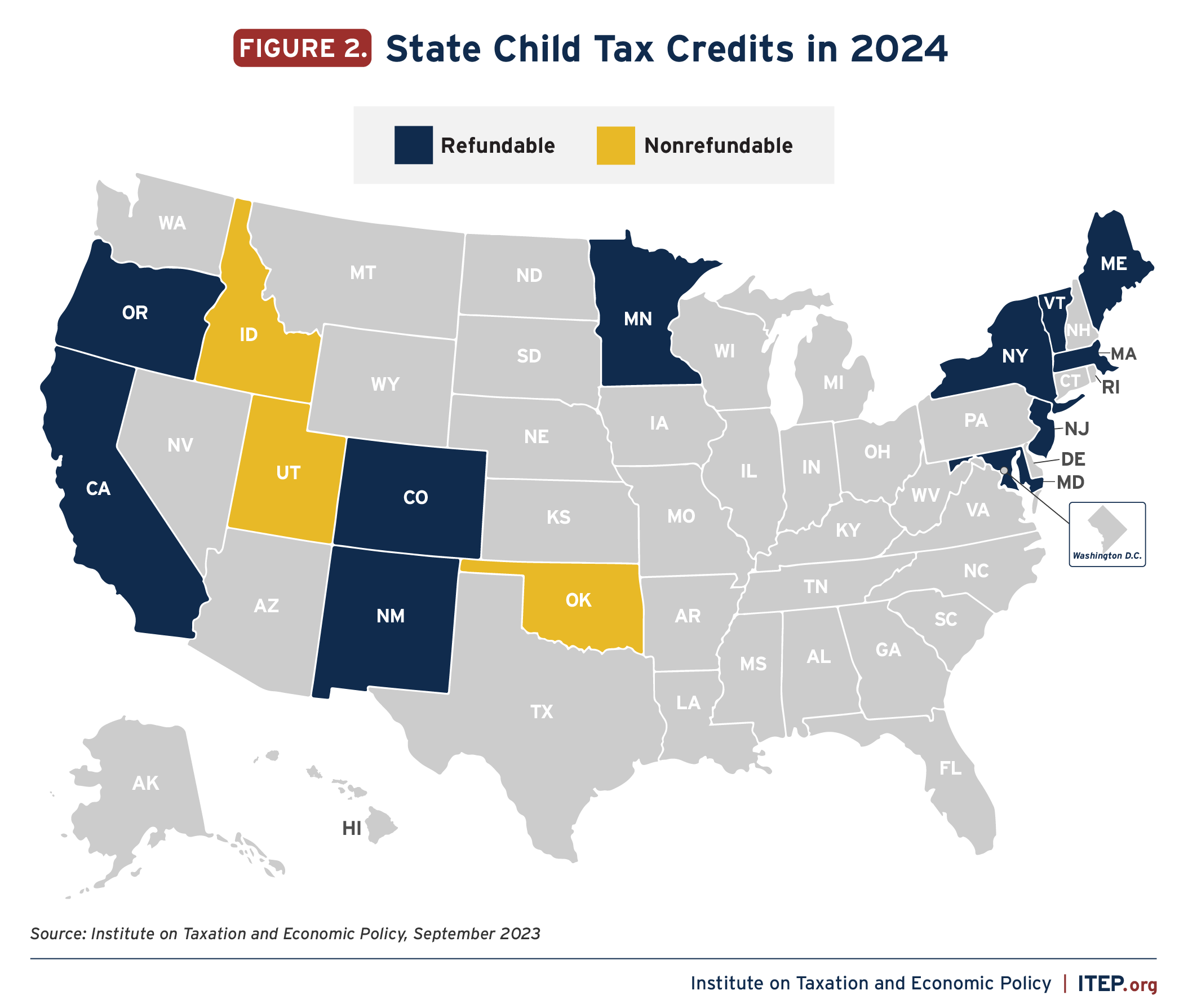

Source : abcnews.go.comChild Tax Credit 2024 Congress Update States are Boosting Economic Security with Child Tax Credits in : The House of Representatives has approved an expansion of the Child Tax Credit which would increase the amount of the refund beneficiaries will receive. . (Wisconsin News Connection) Tax-filing season is underway, and Congress is one step closer to helping low-income families get a bigger break on their returns. Policy experts say a new expansion of the .

]]>